Presenting at Collaborate North America 2025, part of a global series of collaborative robot conferences produced by Universal Robots, Alex Shikany, EVP of A3 – Association for Advancing Automation, painted a vivid picture of the current and future state of automation. With a focus on robotics, machine vision, and motion control, Shikany highlighted the transformative potential of these technologies across various markets. His insights offered a glimpse into a future where humans and machines collaborate more closely than ever before.

“What does our future actually look like?,” Shikany posed this question to attendees at the Novi, Mich.-based event. “When I joined A3 12 years ago, the technologies that you see behind you [cobots on the show floor] would have been what I led with because collaborative robots without safety fencing and guarding were a very new development.

| Read this related article, “Innovative New Robotics at PACK EXPO” |

“But now, when we ask that question today, we see something that looks a little bit more like this [humanoid robots]. … Now, what does our future look like? Does it look like this, where human beings are supporting autonomous legged robots or robots are doing the work that just decades ago human beings were doing all by themselves in a manual operation? Maybe, we’ll see. The jury is out. But this technology for the first time in history is now a reality for us. This isn’t just a dream, this is not just science fiction, and that’s what excites us.

“Human beings and machines are going to be working more closely together than ever before as we move forward.”

Setting the stage for this prospect, Shikany gave an update on the current state of the automation market, new technology, and information gathered from A3 members on their thoughts about the industry.

Material handling applications emerge as key growth area

The automation market, particularly in North America, has experienced its share of ups and downs. In 2023, the robotics market saw a 30% decline, a stark contrast to the pandemic-induced surge in demand for automation solutions. “Coming out of COVID-19, you saw us soar to record heights in this market,” said Shikany. “You might have seen stories about how robotics and automation were producing masks, were helping deliver PPE, doing all these things that were important during the pandemic.

“Was that the new normal for our industry? Well, in short, the answer, at least over the last two years, was no. Because when you look at what happened in 2024, you can clearly tell we had a flat year, with only 0.5% growth upward in North America.”

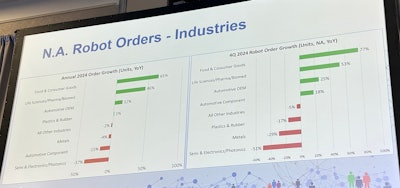

Traditionally, the automotive sector has been a stronghold for robotics, but since 2020, non-automotive applications have outpaced automotive, with the exception of 2022.

“The automotive market made a miscalculation,” said Shikany. “The manufacturers of automobiles and by extension, the component suppliers, made a big bet on electric vehicles. They made a big bet, and in my view, somewhat of a miscalculation on the amount of demand that was on the other side of that fence. … in 2022, there were $27 billion in cancelled battery investments. That is a direct indicator telling you there was a pivot in their strategy, and that pivot was because of the sales that weren’t panning out the way they thought they would. … Now they’ve pivoted. They know their future strategy, and now they’re going to begin ordering automation and deploying automation to support the production of vehicles.”

Meanwhile, material handling applications have emerged as a key growth area, rising 10% from 2023 to 2024, with robots increasingly being used for packaging, palletizing, and pick-and-place tasks.

“So if you are sitting there as a user of these technologies, maybe you create a product, distribute a product, and you’re not considering automation for that step [material handling] in your operation, I’d say now is the perfect time to do that,” said Shikany. “There’s never been a better time in terms of affordability, ROI, what your competition is doing. You need to consider doing that right now.”

A further look at 2023 and 2024 data shows that the industry experiencing the most rapid integration of robotics, with a Q4-24 order growth (in units, North America, YoY) of 77%, is the food and consumer goods sector. Said Shikany, this is indicative of a broader trend where industries traditionally reliant on manual labor are beginning to see the benefits of integrating automated solutions.

AI makes data more actionable

Looking ahead to trends in the coming year, Shikany shared how the growth in U.S. parcel delivery volume will impact automation. Referring to statistics from Pitney Bowes, he said that parcel volume stayed relatively consistent during COVID, but began showing an upward trajectory in 2024.

“So this industry, warehousing and logistics, is incredibly important to automation going forward because of the demand necessary,” he said. “AMRs [autonomous mobile robots] and AGVs [automated guided vehicles] are a huge part of warehousing. When you walk into a warehouse, you now pretty much will see an AMR moving a rack or an AGV doing some sort of material handling or transportation application.

“Just about six or seven years ago, this was a technology like collaborative robots were 12 years ago. We were just starting with it. … Now it’s basically maturing in the warehousing market, but we’ve got a long way to go.”

It is in this environment where humanoid robots could find a place. “This is something we’re watching,” said Shikany. “Humanoids offer a different value proposition to AMRs and AGVs because the idea in a nutshell from humanoid companies is that human robots provide an opportunity to deploy an automation solution in an environment that was designed for a human being. As we know, there are places where we wouldn’t want an AMR to go, such as areas where the shelves are close together.”

Two other applications that Shikany said “have severe upward mobility for these [robotic] technologies” are agriculture and construction. “What I’m hearing is that these industries are really seriously looking at this technology and deploying it at a very quick pace.”

As for the technology driving these new applications, Shikany said that vision is being used in a large portion of them. Within machine vision, the latest technology trend is AI and deep learning. He added that 3D vision is also becoming more popular as well as non-visible imaging and industry 4.0.

“The idea is that everything needs to be connected. If you need good data to make decisions, if your automation line or your production area need data to operate, which many do today, a good way to get good data is to have a camera system, a vision system, a data acquisition tool, and it’s repeatable,” said Shikany.

When it comes to new automation technologies such as AI, the role of government initiatives cannot be understated in this evolving landscape. One of President Trump’s first acts in office was to announce the Stargate project. “The Stargate project is essentially a commitment by the United States government, along with significant financial backing from financial stakeholders like Microsoft, Nvidia, and OpenAI to make the most conducive environment ever created for artificial intelligence and technological advancement,” explained Shikany. “Now, that’s a big promise, and it is yet to be seen if it will materialize, but It’s a start.”

A3 survey responses provide insight for 2025

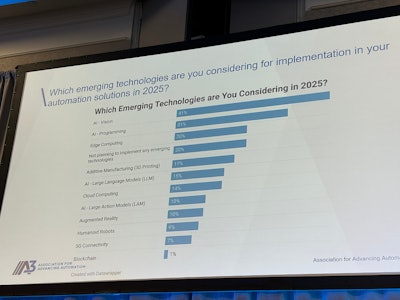

To provide attendees with some insight on where the automation industry sees the market going in 2025, Shikany shared results from a survey of A3 members. A3’s global membership includes 1,300-plus organizations from robotics, machine vision, motion control, and artificial intelligence, composed of manufacturers, distributors, users, and integrators. Following are some of the key takeaways:

1. When asked which industries will be key growth drivers in 2025, respondents chose general factory automation/manufacturing as their top selection, followed by automotive, electronics/semiconductor, aerospace, and food and consumer goods, with six other industries bringing up the rear.

2. Regarding sales for the coming year, A3 members expressed optimism, despite somewhat of a guarded outlook for the first two quarters. “Optimism for the full year is outpacing the optimism for the first half,” said Shikany. “And what that tells us is people expect the back half of this year to be stronger than the first half.”

3. How concerned are A3 members about the global economy? The numbers are fairly normally distributed, although slightly skewed towards more concern rather than less, but not by much.

4. When asked if members are hiring, the answer was, “Yes.” Said Shikany, “In fact, even after two years of essentially flat performance below market expectation, 60% of the industry is still bringing on people. Humans are still an incredibly important piece of this puzzle.”

5. When asked what emerging technologies they are considering, respondents answered that the top three were AI – vision (41%), AI – programming (31%), and edge computing (20%).

6. When asked what the most significant challenge facing automation in general is today, number one was economics, and two was lack of skilled workforce. “We need to get more people involved and interested in this community because jobs are available at all these companies, and they’re not just jobs, they’re great careers with upward mobility. … We need our children and the industry at large to recognize that,” said Shikany. The third challenge was high initial investment in technology.

7. When asked where (in the world) the most significant opportunity for growth exists in the next five years, the U.S. and North America were named as the top two markets, followed by China.

8. Where is the greatest opportunity in the U.S.? “Folks we’re sitting in it,” said Shikany. “We’re sitting right here in the Midwest. This was the number one by far. This was over 40% of what people told us. A lot of SMEs (small and medium-sized enterprises) here need to modernize, they need our equipment, they need robotics and automation.”

The future of automation

Wrapping up his presentation, Shikany referred back to the question he opened with: What does our future look like?

| Read this related article, “Survey: AI Chat-enabled Packaging Machine Copilots to the Rescue?” |

“I think our future looks a lot more automated,” he said, “but not in a bad way. In a way where you have much better tools to work with. And so if we think about these technologies, we shouldn’t be constantly thinking about them in the context of they’re going to take away human work. They’re empowering workers with better tools, they’re allowing the human-operated, human-grown companies that we all have and work for and support to do their job better, to become more profitable, and in turn, hire more people.

“It’s early days folks. We’re still in the early innings. Some of these applications, these industries I went through are just now scratching the surface. When we went through that bar chart of robot deployment, if I come back in a year, two years, five years from now, that’s going to look a lot different, and the magnitudes are going to be a lot more.” PW

.OvcZHe3G0k.jpg?auto=compress%2Cformat&fit=crop&h=67&q=70&w=100)